FAMILY TAKAFUL

What is family takaful?

Family takaful provides you with a protection and long-term savings. You or your beneficiary will be provided with financial benefits if you suffer a tragedy. At the same time, you will enjoy a longterm personal savings because part of your contribution will be deposited in an account for the purpose of savings. You will be able to enjoy investment returns from the savings portion based on a pre-agreed ratio.

Types of cover

Family takaful can be grouped as follows:

- Ordinary family

Individual family takaful (individuals) – The plans include education, mortgage, health and riders. You will receive financial benefits arising from death or permanent disability, as well as long-term savings (investment), and investment profits that are distributed upon claim, maturity or early surrender. - Group family takaful (employers, clubs, associations and societies) – The

plans include group education, group medical, health and riders. A minimum

number of participants are required to qualify under these plans. You will receive

protection in the form of financial benefits arising from death or permanent

disability. - Annuity – a plan that provides regular income upon your retirement.

- Investment-linked – A portion of your contribution is used to buy investment units, such

as units in equity or fixed income securities. The takaful protection covers death and

permanent disability.

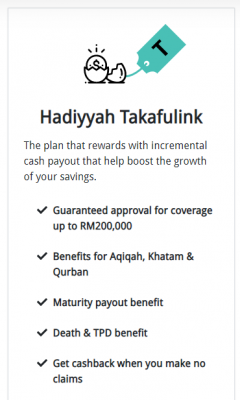

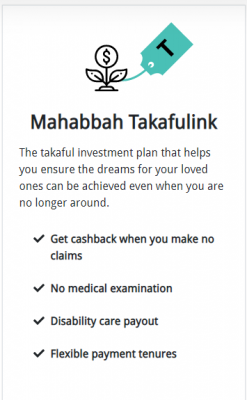

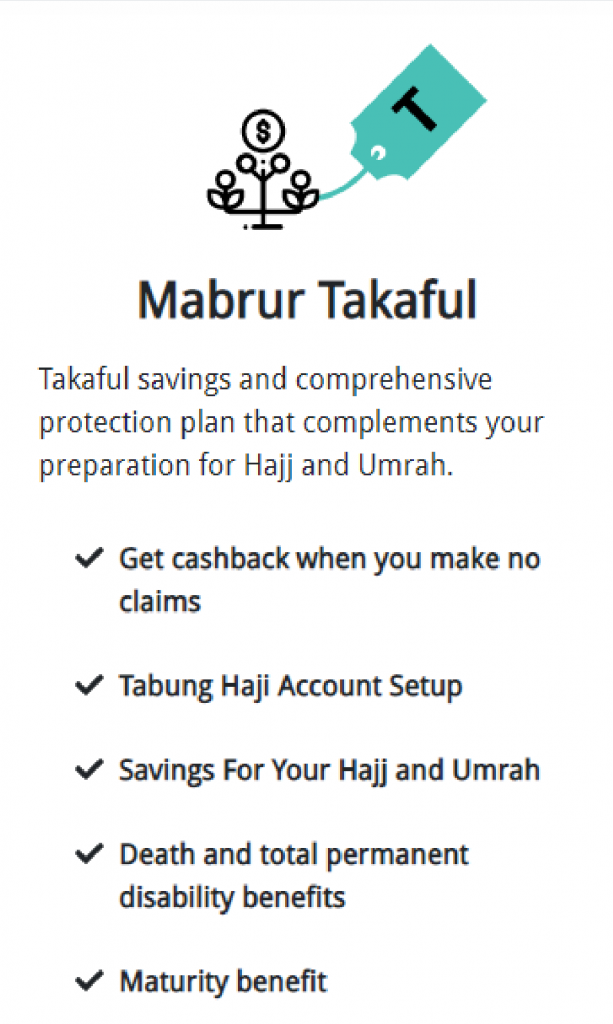

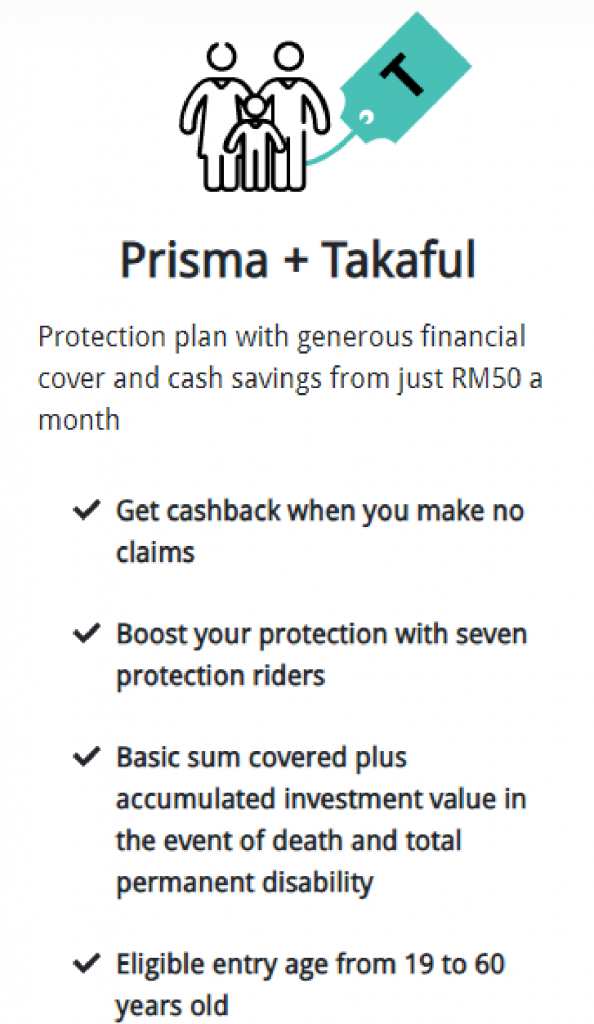

Savings Insurance and Takaful Flexible savings plans with protection for your lifestyle.

Savings Insurance and Takaful Flexible savings plans with protection for your lifestyle.